Historic Renovations and Tax Credits in NC

In our city of Asheville, NC, we are fortunate to have many historic properties intact, contributing to the uniqueness of our town and culture. Making the decision to purchase and renovate rather than build new can be difficult, with many factors to consider, such as location, cost, and schedule.

In our city of Asheville, NC, we are fortunate to have many historic properties intact, contributing to the uniqueness of our town and culture. Making the decision to purchase and renovate rather than build new can be difficult, with many factors to consider, such as location, cost, and schedule.

For those who simply love older homes, rehabilitating the structure offers a way to preserve a celebrated architectural style from the past while incorporating modern living conveniences of today. Although age and neglect may require updating of systems and finishes, often the bones of a historic structure are built to last, but knowing what to preserve and what to renew can be tricky. There are several architects, design professionals, and builders are skilled at bringing renewed life to historic structures to showcase their true beauty and appeal. Although contemporary design is trending, many Asheville residents are proactive in preserving the historical buildings, so future generations can enjoy their charm as well.

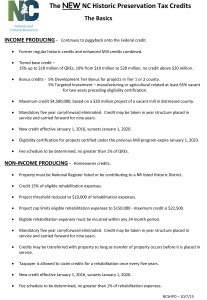

With cost playing a huge role in the feasibility of a project, the North Carolina Department of Natural and Cultural Resources has outlined the new state sponsored NC Historic Preservation Tax Credits for 2016. When dealing with historic properties, replacement products and fixtures are not only hard to find, but often cost much more than their modern counterparts. These tax credits help ease the financial burden of rehabilitating a property.